The "I Don't Know Where It Went" Syndrome

I want you to open your banking app right now.

Don’t just glance at the balance. Look at the transactions from last Tuesday. Do you even remember buying that stuff? Probably not.

For years, this was my life. I’m a developer. I build systems for a living. I deal with logic, variables, and predictable outcomes every single day. But when 5:00 PM hit and I closed my laptop, I turned into a complete chaotic mess with my own wallet.

I would earn a decent salary, feel "rich" on payday, and then feel that familiar knot in my stomach around the 24th of the month. You know the feeling. The "I hope the mortgage payment clears before the grocery bill hits" feeling.

I wasn’t broke because I wasn’t earning enough. I was broke because I was driving my financial life looking exclusively in the rearview mirror.

Most of you think you have a budget. I’m here to tell you that you probably don’t. You have a tracker.

There is a massive difference.

- Tracking is looking at a receipt and saying, "Oh wow, I spent $400 on takeout last month. That’s bad."

- Budgeting is looking at your money before the month starts and saying, "I have $50 for takeout this month. If I spend it all on pizza this Friday, I am eating beans until the 30th."

One is an autopsy; you’re just figuring out how the patient died. The other is a treatment plan to keep the patient alive.

If you want to go out of debt—and I mean really destroy it, not just move it around between credit cards—you have to stop acting like a spectator in your own life.

The "Zero-Based" Logic (Or: Giving Every Dollar a Job)

When I finally snapped and quit my job (again, bad idea, don't recommend it without savings), I had to treat my household finances like a software project with zero margin for bugs.

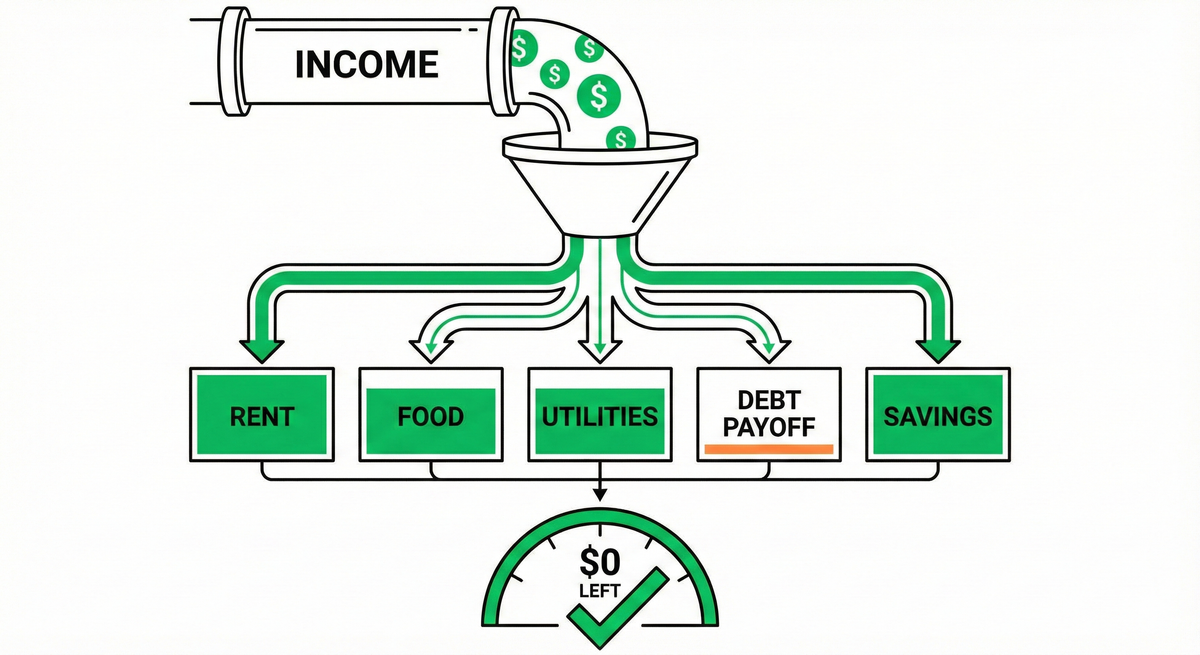

I stumbled onto a concept called Zero-Based Budgeting.

Forget the fancy name. Here is the logic: Income - Expenses = $0.

This doesn't mean you have zero money in the bank. It means every single unit of currency you earn is assigned a specific task before it hits your account.

If you make $3,000 a month, and you write down a list of bills that totals $2,500, you have $500 floating in the void.

That $500 is dangerous. It is a leak in the hull.

If you don't name it, it will vanish. It will turn into gas station snacks, a subscription you forgot to cancel, or a "treat yourself" moment that you didn't actually budget for. By the end of the month, it's gone, and you have nothing to show for it.

In a Zero-Based Budget, that $500 gets a name immediately. Maybe $300 is named "Student Loan Extra Payment" and $200 is named "Car Repair Fund."

$3,000 (Income) - $3,000 (Assignments) = $0.

That is the game. When you do this, you aren't restricting yourself. You are giving yourself permission. If I budget $100 for video games, I can spend that $100 guilt-free. I don't have to worry if I can afford it, because the math already said yes.

The Algorithm: How to Actually Do It

You don't need a degree in economics. You need 30 minutes and a glass of wine (or a strong coffee). Here is the code:

1. The Hard Truth Input

Open Excel, Google Sheets, or grab a piece of paper. Write down your reliable take-home pay. Do not include the "maybe" bonus or the money your cousin owes you. Only list the cash that actually hits the wire.

2. The "Four Walls" Logic

Before you pay a single dime to a credit card company, you secure your perimeter. If you get evicted, you can't fix your finances.

- Rent/Mortgage

- Utilities (Lights/Heat/Internet)

- Food (Groceries only, not restaurants)

- Transport (Gas/Bus pass)

If you can't cover these, you don't have a budgeting problem; you have an income crisis. That’s a different article.

3. The Variable Chaos

This is where 90% of people fail. They forget that life isn't a flat line. You will need a haircut. Your car will need oil. Your friend will have a birthday. If you don't put a line item for "Gifts" or "Maintenance," you are lying to yourself. You are building a system that is designed to crash the moment reality hits it.

4. The Debt Destroyer

Whatever is left after steps 2 and 3 is your weapon. Most people send "whatever is left" to their credit card debt. But because they didn't do the math, "whatever is left" is usually $20. When you zero-base budget, you might realize you actually have $400 available. But you have to physically move that money the day you get paid. If you wait until the end of the month, the money will be gone.

Why You Will Hate This (At First)

I’m not going to sugarcoat it. The first month you do this, you will feel like you are in a straitjacket.

You will realize just how much money you were wasting on nonsense. It’s painful. You will want to buy a sandwich for lunch, check your category, see you have $0 left for "Dining Out," and have to eat the leftovers you brought from home.

You will feel poor.

But here is the shift: You aren't poor. You are just finally paying attention.

That tight feeling? That’s the feeling of traction. That is the feeling of wheels finally gripping the road instead of spinning in the mud.

The "Buffer" Variable

In software, we have error handling. If the code breaks, we catch the exception so the whole app doesn't crash. Your budget needs a try/catch block.

I call it the "Stuff I Forgot" category. For your first three months, put $50 or $100 in a category labeled "Oops." Because you will forget something. You will forget the annual Amazon Prime renewal. You will forget that you need to buy renewed registration tags for the car. When that happens, instead of quitting the budget and saying "this doesn't work," you just pull money from the "Oops" category.

The End Game: Aging Your Money

When I started, I was living on the edge. The money that came in on the 1st was gone by the 2nd.

The goal of this system is to get to a point where the money you earn in January is used to pay the bills in February. This is called "Aging Your Money."

Imagine the stress relief. Imagine getting a bill in the mail and knowing the money to pay it has been sitting in your account for 30 days, just waiting. That is financial independence. It starts with the boring, unsexy work of opening a spreadsheet and telling your money where to go.

Your Assignment

Don't just read this and nod. Tonight, before you watch Netflix, log into your bank. Look at your last 3 months of spending. Find the leak. Then, create your Zero-Based plan for next month.

If you don't control your money, the bank controls you. And the bank doesn't care about your dreams.